What’s Up With Gas Prices?

An ancient philosopher once said, “May you live in interesting times.” If the past few months were any indication, I would say we are definitely living in interesting times. They may not be enjoyable, or profitable, but interesting.

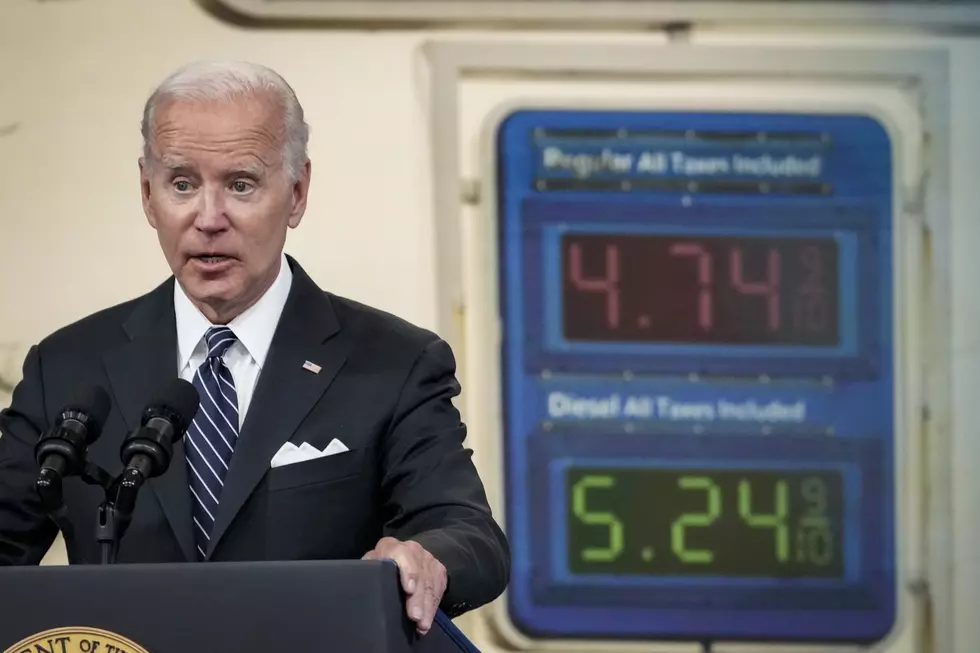

Between 2000 and 2007 the average price of gasoline was $1.91 and we were screaming about it. How we would love to go back to those days now. In 2007, due to the ever-increasing price of crude oil, the average price of gas jumped to $2.80. On inauguration day in 2009 oil was $40.84 per barrel and the average price for a gallon of gas was $1.843. Gas in California has increased to over $5.00 a gallon and nation wide it’s kissing $3.90.

Why The Wide Speculation?

In the California case, too many different blends, and a refinery shutdown caused supplies to contract raising the price. In other cases, an increase or decrease in use can cause fluctuation in isolated areas or worldwide.

Would more drilling here help? Probably not and here’s why. Put yourself in the driller’s shoes. You have oil and you need to sell it to recoup your investment and hopefully make a profit. You could sell it in the US, where demand is lower than other parts of the world, and make less; or you could sell it on the world market and make more. Which would you do? The farmer wants to sell his or her corn does it make a difference to the farmer if it goes to Alabama or Bangladesh? When you have everything you own on the line it’s hard to sympathize with someone demonstrating on Wall Street who sees you as a selfish, greedy crook.

Who Pays The Increase?

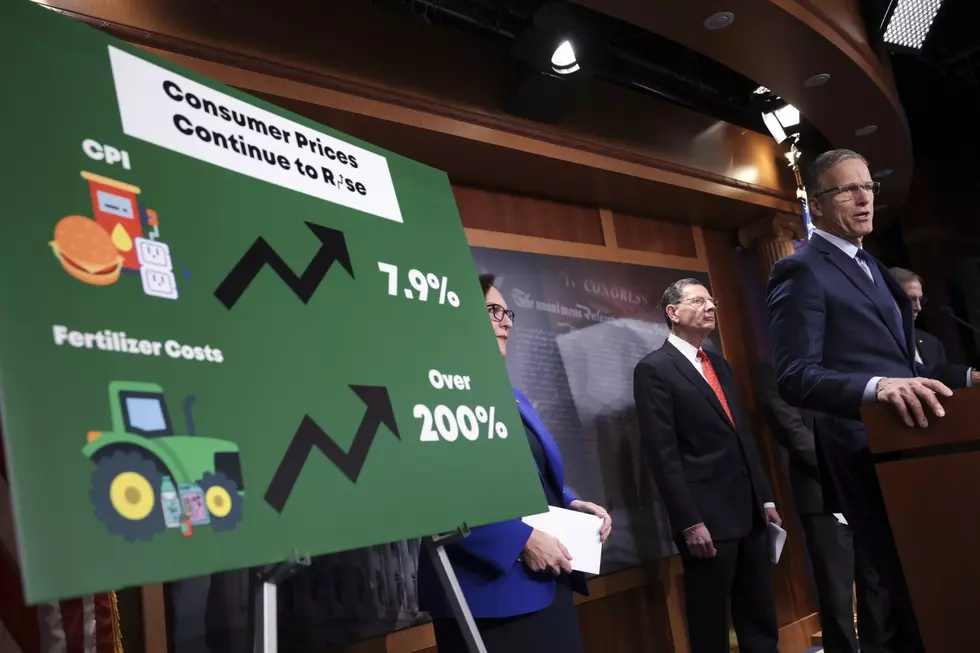

During that seven-year span, with gas averaging $1.91 a gallon, most retailers including Wal-Mart absorbed the bulk of it and we could still get eggs for .99 a dozen. Fast forward to the spring of 2008, when gas moved from $2.80 to $3.79 or more, and diesel moved even higher. Absorbing those numbers were no longer possible for the average retailer or even the big box stores. It became a cost that had to be passed on to the consumer in the form of higher prices. Why? — Because it’s what we’ve always done when costs increase.

Who Is The Consumer?

The consumer is the person working right along side you as you read this. The cost of materials goes up, the cost of moving those materials goes up, the cost of producing the materials goes up, the gross income goes up, but the profit goes down, while employee salaries, health insurance, and taxes remain the same for the most part. So, in essence, we are passing higher costs along to people whose income remains the same and expecting them to keep buying just like they always did. Talk about being between a rock and a hard place.

Now we have created an environment where your employees can’t pay their bills on what you are paying them. They will have to look for second jobs. Whoops… I forgot we’re in Montana; they already have second and probably third jobs. If you can’t afford to pay them more, then you are in danger of losing a good employee. And if you do give them raises, to whom are you going to pass that expense on to?

Where is Superman when we need him?

Whenever the public screams loud enough one champion always rides to the rescue. The United States Government, on its white horse with its incredibly deep pockets to bail us all out. Suddenly there was $600.00 for each taxpayer somewhere in the budget. Who knew? It must have been overlooked in a back closet over at the treasury building. Plus, it’s an election year. Gotta buy votes.

Gas Math

Let’s go back to school for a moment. Remember math? Yeah, I hated it too. Remember I said gas averaged $1.91 between 2000 and 2007, and $2.80 in 2007. Gas taxes are fixed amounts, not percentages of the total, and do not fluctuate with the final price. During those six years your gas tax was 24% of the total cost to get it to the pump. So on $1.91 your tax was $.46 bringing gas down to $1.45 per gallon. Those were the days. Moving to 2007 and gas at $2.80, due to crude oil increases, and the fact that gas tax is a fixed amount, and not a percentage, we see that you would now be paying 15% of the pump price in gas tax. So for your $2.80 gas you would save $.42 and be paying $2.38 per gallon. And in 2008, at $3.79 it would be even less of a savings. At the same time the profits of the local gas station operator have increased a very modest 1%.

Some Final Thoughts

There is always an answer. But, it can’t endanger the Spotted Owl or contribute to global warming. The simple answer to this, and most problems, is business. Business is self-correcting, it levels its own playing field as long as politicians stay out of the way and stop trying to redirect it. Business finds a way to be successful. Are there painful times while business self corrects? You bet. No one said life is fair or profitable.

If your business is built on low price you are going to be facing some serious problems in the months ahead and may not be here this time next year. My advice, to those of you who sell quality products at a fair price, start identifying those customers with a higher disposable income. There are groups of people who are above current conditions. They will get you through the toughest times. We got in this together; we’ll get out of it together. But it won’t be tomorrow.

More From KMMS-KPRK 1450 AM