What Are Your Chances of Being Audited?

What should you do when the IRS comes knocking? When I moved to Montana I was audited three times in the first five years I lived here. The first time my return was correct and there was no action, the second the IRS found I owed a small amount and the third time they owed me. After they had to pay me I was never audited again.

What Triggered So Many Audits In Those First Few Years?

I had a home-based business along with a full time job. In the early nineties that alone was enough to trigger an audit in most cases. There were a lot of people using fake home based businesses to deduct almost every action in their daily lives. Most were nothing more than glorified hobbies where no real income was realized.

What Are The Red Flags The IRS Looks For?

With electronic filing and computerized tax software it’s easier than ever for the IRS to spot little things that don’t seem exactly right. Here are a few to watch out for:

- The higher your income the greater chance you will be audited. About 1 in every 16 people making over $100,000 will come under the IRS magnifying glass.

- Lots of deductions will also call attention to your return. If your deduction to income ratio is too high the IRS will probably have a chat with you. By all means take every legal deduction but be sure you are able to back them up with receipts and accurate records.

- The Home Office Deduction: If you are using a spare bedroom as an office it has to be used exclusively for business use. Don’t use a corner of the kid’s playroom and try to deduct the square footage of the whole room. It will be disallowed.

- Report your 1099’s: If you are an independent contractor you will receive an IRS form 1099 for any payments over $600. Any IRS form you receive also is sent to the IRS so make sure all incomes and expenses are accounted for.

- Business loses: The IRS will allow you to lose money while your business grows but not forever. If your business constantly loses money year after year the IRS just might declare it a hobby and disallow all your business deductions. Sooner or later a business has to move into the black.

- Donations: I happen to think my autograph is very valuable. The IRS does not. If I claim a donation of over $250 I need a receipt from the charity or in the case of art, an appraisal would have to be produced. And, only a certain portion of your income can be given to charity and still qualify as deductible.

Some Final Thoughts

IRS audits are nothing to fear if you keep accurate records. Business expenses are deductible for a reason. They are there to keep your business in business so you will have enough income from day one to keep your business viable.

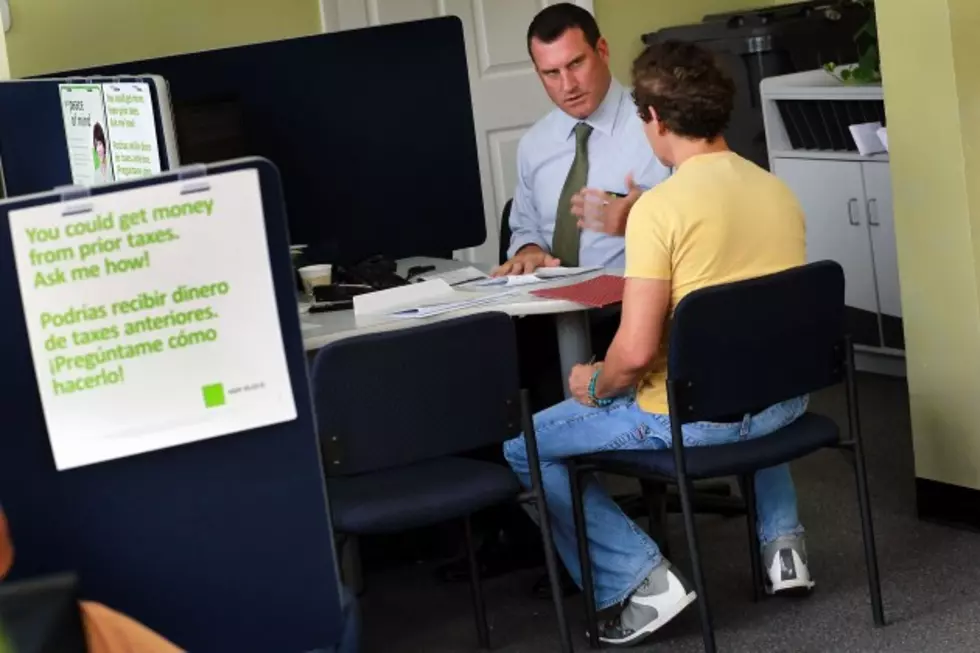

Dollars are tools. Keeping as many as you can is your responsibility. Good accountants and bookkeepers are worth their weight in gold. Sit down with one and get your business organized and your next audit, if you have one, will just be a waste of IRS time.

More From KMMS-KPRK 1450 AM