Expectation of Trump Tax Cuts Could Be Hurting Montana Budget

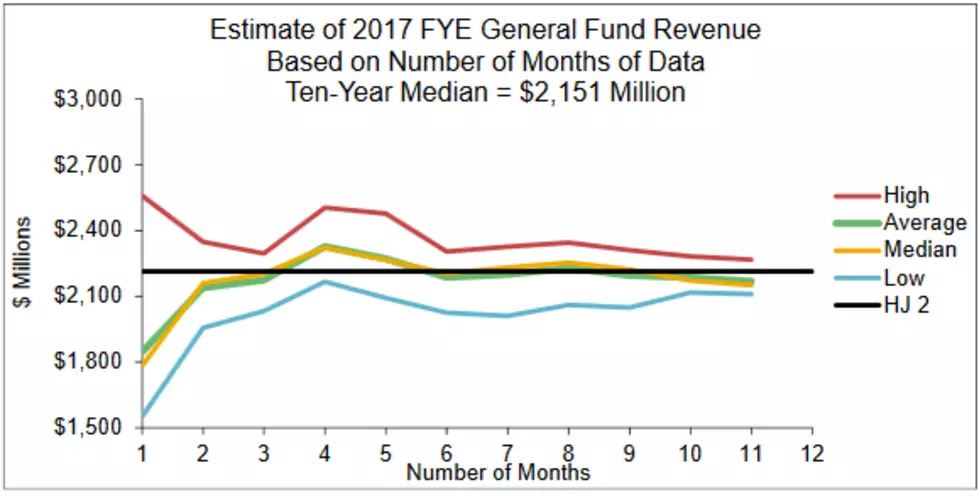

When the legislature worked on setting the state’s budget it relied on a revenue forecast created by the Legislative Fiscal Division. As of the end of May though, the actual revenue accrued by the state is far below what the forecast had predicted. According to Montana Senate Finance and Claims Chairman Llew Jones, an expectation that Donald Trump may cut capital gains taxes may be the biggest cause of the revenue problem.

"On the income tax side, folks are not taking capital gains at the rate they were before," said Jones. "So they are not cashing in stocks or selling off depreciated assets at the same level. The theory and some of the anecdotal evidence that has been gathered by talking to individuals is that there is at least some expectation that there will be a tax cut on capital gains."

Though it is expected that people will eventually liquidate those funds, the delay could lead to major cuts in many Montana departments.

"While it may be a short-term hiccup," Jones said. "The challenge we have in Montana is that the State of Montana pays its bills in real time. It was already a tight budget and this has tightened it further. There are some triggers that are set in the budget, in particular, in Senate Bill 261, that speak to some additional cuts that will need to made if the revenues don't show up."

Governor Bullock’s budget director Dan Villa appears to be expecting major cuts to go through and has already asked state agencies to prepare for the worst. At the end of last month the State’s General Fund Cash Balance was down to just $76 million, Montana had a $343 million fund balance just one year ago.

More From KMMS-KPRK 1450 AM

![Governor Threatens Budget Veto – State Headlines [YouTube]](http://townsquare.media/site/119/files/2015/03/steve-bullock2.jpg?w=980&q=75)